Clear Vision Accountancy Group News

If you own a rental property or holiday home, keeping the right records is key to maximising your tax deductions and staying ATO-compliant. This week, we’re highlighting what the ATO expects you to keep when it comes to residential rental properties. Here’s a quick checklist of the documents you should hold onto: Purchase & Sale Documents – Contracts, settlement statements, and legal documents. Loan & Ownership Records – Loan statements, refinancing documents, land tax assessments. Rental Income – If you don’t have a rental statement you will need to document all rental income received, including bond money retained, insurance payouts, and any other reimbursements. Expenses & Repairs – Keep receipts and invoices for expenses like advertising for tenants, property agent fees, council rates, strata levies, repairs, maintenance, insurance, and interest on loans. Depreciation & Capital Works – Receipts for assets over $300, depreciation reports, and capital improvement records. Before and after photos of any capital works. Holiday Home Use – If your property is rented out part-time, you’ll need evidence of when it was genuinely available for rent (e.g. booking requests, advertising, availability calendars). How long to keep records: You’ll need to keep most records for at least 5 years after lodging your tax return, or longer if claiming capital works or carrying forward losses. Keeping detailed records ensures you claim everything you're entitled to—and makes things much easier in the event of an ATO audit. Need help getting your documentation in order? Reach out to our team at Clear Vision Accountancy Group—we’re here to help. To read a more detailed list of items you need to keep for your rental property visit: Records for rental properties and holiday homes | Australian Taxation Office

Running a business isn’t just about making sales — it’s about making enough sales to cover your costs and pay yourself what you deserve. But how do you figure out how much turnover (aka revenue) you actually need to make each month? Knowing this number helps you: Set realistic sales targets Price your products or services properly Know when to cut costs or increase margins Understand when your business is sustainable This isn’t just about numbers — it’s about clarity and control. Once you know your required turnover, you can stop guessing and start planning. Whether you’re a solopreneur, a growing startup, or a small business owner, this is the foundation of making your business work for you — not the other way around. We love numbers — seriously. And we get that not everyone does. If you need help breaking things down in a way that’s simple, practical, and actually makes sense (even if numbers aren’t your thing), call Clear Vision Accountancy Group today on 4688 2500.

From 1 July 2025, the Superannuation Guarantee (SG) rate in Australia will increase to 12%. This means employers will be legally required to contribute at least 12% of an eligible employee's ordinary time earnings to their superannuation fund. This increase is the final step in a legislated rise from 9.5% in 2021 to 12% by 2025, aimed at boosting retirement savings for Australian workers. If you use Xero for payroll, the SG rate should automatically update in the system. However, we recommend you double-check your payroll settings to ensure everything is correct. If you’re unsure or need assistance, please contact your bookkeeper or get in touch with us at: Clear Vision Accountancy Group (07) 4688 2500 We’re here to help you stay compliant and avoid any costly errors.

As we step into the final week of autumn and feel winter’s chill approaching, it’s a natural time for reflection—and that includes taking stock of your financial and tax situation. The end of the year is closer than it seems, and a bit of preparation now can make a significant difference come tax season. Here are a few things to consider as the leaves fall: 1. Review Your Income and Deductions This is a good moment to check your income year-to-date and consider whether there are any deductions you can still take advantage of. Charitable donations or investment losses might help reduce your taxable income before year-end. 2. Maximise Super Concessional Contributions If you haven’t yet maxed out your superannuation concessional contributions, there’s still time. Remember unused cap amounts carry forward for 5 years and the 2019-20 unused cap amount will expire 30 June 2025. These contributions not only help secure your future but can also offer tax benefits now. 3. Organise Your Records Autumn’s slower pace is perfect for pulling together receipts, invoices, and financial documents. Getting organised now means less stress later when tax season begins in earnest. 4. Consider Tax-Loss Harvesting If you’ve had investments that underperformed, selling them before the end of the year to offset gains can be a strategic move. Consult with us today to see if this makes sense for you. 5. Plan Ahead Winter may bring holidays and downtime, but it's also a good window to consult with a tax professional. A quick meeting before year-end can reveal savings opportunities or help avoid surprises when you file. So, as the days grow shorter and frost begins to settle in, use this time to bring clarity and warmth to your finances.

At Clear Vision Accountancy Group, we offer tailored services to support your long-term success—from strategic business planning to high-end tax administration. Whether you're aiming for growth, improved profitability, or a clearer direction, we're here to help you build a plan that gets results. If you're ready to map out the next five years with clarity and confidence, contact us today on (07) 4688 2500. Our 1-Page Business Plan will help you with: 1. Vision & Purpose Where are you headed, and why does it matter? What is the core purpose of your business? In five years, what positive impact will you have made on your customers, team, or community? What do you want your business to be recognised for within your industry? 2. Growth & Scale What does success look like, and how will you achieve it? What revenue, profit, or market position are you targeting? How many clients or customers do you want to serve—and in which markets? Are you planning to expand your offerings or enter new territories? 3. Team & Culture Who is helping you build it—and how? What does your ideal team look like in terms of structure, culture, and capabilities? How will you attract, retain, and develop top talent? What kind of leadership values and workplace environment will you foster? 4. Operations & Systems How will you deliver at scale—efficiently and reliably? What systems and workflows need to be in place to support sustainable growth? Which technologies or platforms will you implement to improve efficiency? How automated or streamlined do you want your business operations to become? 5. Brand & Customer Experience What do customers say about you—and why do they keep coming back? How will clients describe their experience with your business? What kind of reputation or brand presence will you be known for? What sets your business apart from the competition ? Our Dream it. Plan it. Get it! will help you with: 1. Lifestyle & Personal Goals How does your business support the life you want to live? What level of involvement do you want in the day-to-day operations? What does ideal work-life balance look like for you? What personal or financial goals will your business help you achieve?

As the end of the financial year approaches, many Australians are looking for ways to reduce their tax burden, and one effective strategy is contributing to superannuation. Paying into super can help reduce your taxable income while also boosting your retirement savings. One of the most beneficial options is to take advantage of carry-forward contributions , which allow you to use unused concessional caps from previous years. How Super Contributions Reduce Tax Contributing to your super fund can lower your taxable income, as concessional contributions (before-tax contributions) are taxed at a lower rate of 15%, rather than your marginal tax rate. This means that if you’re a high-income earner, salary sacrificing or making personal deductible contributions can significantly reduce your tax bill. The concessional contribution cap increased on 1 July 2024 to $30,000, which includes employer contributions, salary sacrifice, and personal contributions for which you claim a tax deduction. Carry-Forward Contributions The carry-forward contributions rule allows you to use unused concessional contribution caps from previous years. You can carry forward unused caps for up to five years . For instance, if you didn't reach the $27,500 cap in past years, you can make larger contributions this year by carrying forward the unused portion. Which Financial Year is About to Drop Off? As the 2024-25 financial year ends, unused caps from 2019–2020 will drop off on 30 June 2025. This means any unused contribution space from that year won’t be available after this date. If you haven't maximised your contributions in previous years, now is the time to catch up. Benefits of Carrying Forward Contributions Maximise Super Savings: You can top up your super by using unused cap space from previous years. Tax Reduction: Making larger concessional contributions can reduce your taxable income and save on tax. More Growth: Additional contributions allow for greater compounding growth in your super. Things to Remember To carry forward unused caps, your super balance must be less than $500,000 . If you exceed the concessional cap, excess contributions are taxed at your marginal rate plus an additional 15% penalty. Contributions must be made by 30 June 2025 to count towards this financial year. If you would like to take advantage of the carry-forward contributions before 30 June 2025 and need help, call us today at 4688 2500 to make an appointment.

The metaphors we use when talking about money are both intriguing and revealing. When we overspend, we say we're "bleeding" cash; when it arrives out of the blue, it's "pennies from heaven." Money holds such importance in our lives, yet so many businesses seem to throw it around without a clear budget. Sticking to a budget is a fundamental aspect of financial health. It also signals to others that you're in control and on top of things. Keeping your business on budget doesn’t have to be a hassle—think of it as a creative challenge. If you're open to putting in the work and making some tough choices, sticking to a budget can be the best workout for your business mind. Do you know how to build a budget that keeps your business safe from financial troubles? We do, and we’re here to help you create a budget that works—and ensures you stick to it. If you need help with your budget give us a call today 4688 2500.

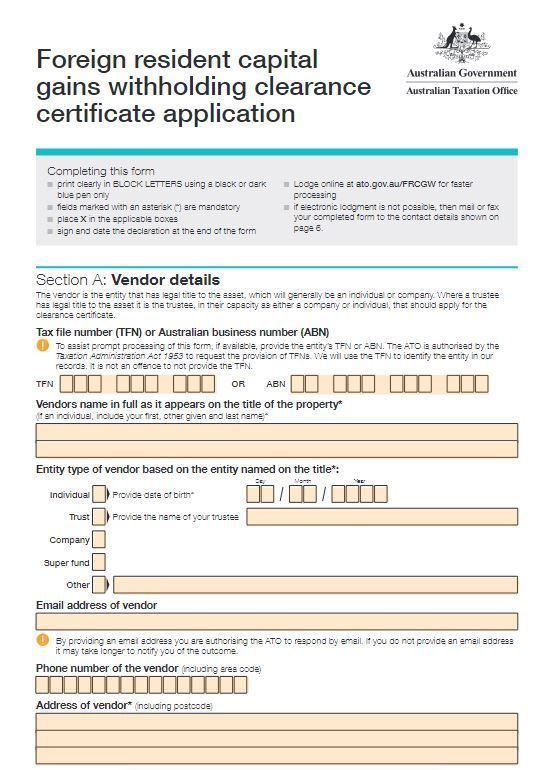

From 1 January 2025 all Australians selling property need a clearance certificate to prevent a portion of the sale price from being withheld. While it is understood that most lawyers are handling this process for their clients, it’s important for everyone involved to be aware of this requirement. Clearance certificates for Australian residents All Australian residents (for tax purposes) selling or disposing of Australian real property (property) must have a clearance certificate and give it to the purchaser at, or before settlement. Without a clearance certificate, the purchaser must withhold up to 15% of the sale (or market value if not sold at arm's length) for foreign resident capital gains withholding (FRCGW) purposes. Example: the importance of getting a clearance certificate early – 15% withheld from sale Willow and Stanley are Australian residents for tax purposes. On 1 September 2024 they decide to sell their family home, their main residence. They need the funds from the sale to purchase a new residence. They are both listed as owners of the property on the certificate of title, so both must apply for their own clearance certificate. They find a purchaser on 8 January 2025 and sign the contract of sale, with a settlement 30 days later on 6 February. They don’t apply for a clearance certificate until 15 January and don't have both of their clearance certificates at, or before settlement. The property sold for $600,000, however: • Willow's clearance certificate issued and was given to the purchaser • Stanley was still waiting for his clearance certificate. The sale goes through and settlement occurs. As Stanley didn't have a clearance certificate at settlement, 15% of Stanley's share of the sale ($90,000) must be withheld by the purchaser and paid to us. Stanley must wait until his 2025 tax return is lodged and processed for a refund. As the purchaser had received a clearance certificate from Willow, there's no withholding required on her share of the sale. (Example provided by the ATO website) If you would like to read more about Clearance Certificates, please click on the below link: https://www.ato.gov.au/individuals-and-families/investments-and-assets/capital-gains-tax/foreign-residents-and-capital-gains-tax/foreign-resident-capital-gains-withholding/australian-residents-and-clearance-certificates#ato-ClearancecertificatesforAustralianresidents

We wanted to bring to your attention some important changes regarding student and training loan indexation that have just passed through Parliament. The law is changing how the indexation on student loans is calculated. In the past, indexation has been based solely on the Consumer Price Index (CPI) . However, moving forward, the indexation rate will be based on the lower of either the CPI or the Wage Price Index (WPI) . This new rule will be backdated to 1 June 2023 , which means it will affect loans from that date onward. Here’s how the updated indexation rates break down: 3.2% for 1 June 2023 (reduced from 7.1%) 4% for 1 June 2024 (reduced from 4.7%). Impact on Your Loan If your loan has been over-indexed in the past two years, you may be entitled to a refund . The Australian Taxation Office (ATO) will automatically adjust your account to reflect the new, lower rates and will process refunds for any excess amounts already paid. This means: If after the adjustment, your account is showing a credit (i.e., you've paid more than required), this excess will be refunded to your nominated bank account provided you have no outstanding tax or other Commonwealth debts . If your loan is in credit after the adjustment, any remaining funds may be transferred to offset your income tax account (if applicable), and the remainder will be refunded to you. What You Need to Do For most clients, there’s nothing you need to do at this stage. The ATO will automatically recredit excess amounts to your account once the legislation receives Royal Assent , and this process will begin soon after. You should expect to see these credits applied to your account by the end of January 2025 . However, in some cases, due to the complexity of individual accounts, it might take a bit longer. Unfortunately, the ATO cannot provide a list of exactly which clients will receive refunds, as they will only know once all recredits are processed. We drew inspiration to write this article from the ATO